Hi, I wanted to take a second to show you how easy it is to pay your tax bill online. The first thing you'll want to do is go to irs.gov. From the home screen, click on the payments tab. Once you're taken to this page, you'll see that there are two different options. You can either use the IRS direct pay, which is free and pays directly from your checking account, or you can pay with a debit or credit card. If you choose the pay by card method, there will be additional fees associated with paying for your tax bill. You'll need to select a processor based on their fees. If you click on the provided link, it will take you to an external site where you can make the payment. However, for the purpose of this demonstration, I will continue with the IRS direct pay method. To use IRS direct pay, click on the designated button. This will direct you to a screen with two options - making a payment or looking up a payment. Looking up a payment is useful if you've made quarterly payments throughout the year and want to verify your records against the IRS's records. To make a payment, click on the corresponding button. This will take you to another screen where you have several options. You can apply the payment to the 1040, 1040a, or 1040ez, which are different types of tax files. For our demonstration, we will choose the 1040, which is a normal tax return. Next, you will be asked to provide a reason for the payment. You can select an installment agreement, pay for the tax return itself, or make an estimated tax payment. For this example, let's choose "tax" and say that you are paying your 2015 tax...

Award-winning PDF software

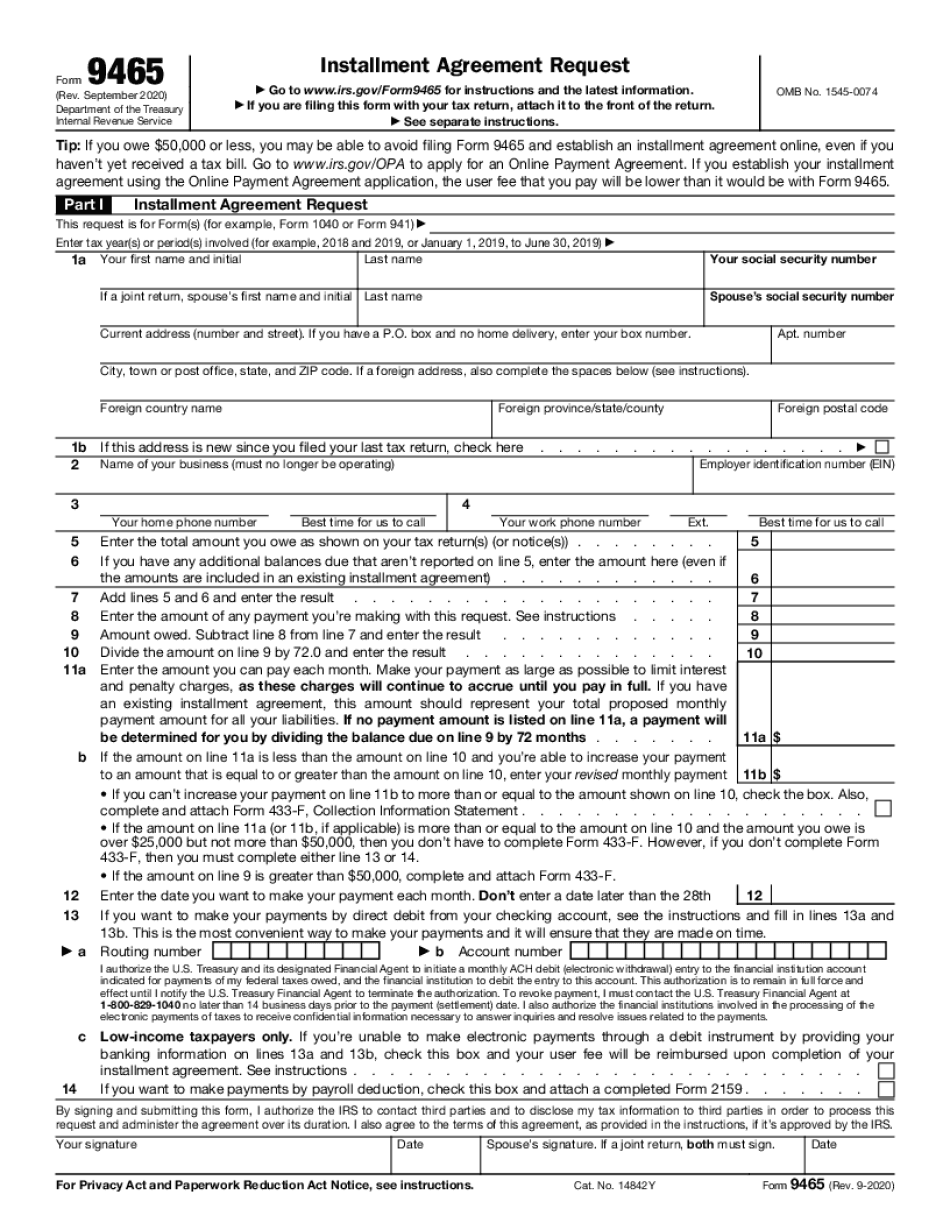

Www.irs.gov/pay installment agreement Form: What You Should Know

Form 1040 | USA Oct 1, 2025 — Make sure you have the correct amount listed on the form when your tax return is filed. The form and the return must not have any errors. Form 1040EZ Tax Return Individual or Partnership | IRS Nov 1, 2025 — Use Form 1040EZ to make a payment before you file your tax return. Form 1040 | USA Jan 12, 2025 — You may be subject to a refund based on a repayment plan that you applied for on your income tax return that includes a payment plan. Contact the IRS at (individual) or 800-829- Payment Plans Installment Agreements — IRS Nov 15, 2025 — If you don't need to pay any taxes, make sure you get it done as soon as possible. IRS Online Payment Agreement Application — IRS Apr 29, 2025 — Once you apply for an installment plan, apply online for a payment plan using your financial institution's web-based or telephone payment process. IRS Direct Deposit to Pay Bills / Other Payments — U.S. Treasury Nov 15, 2025 — Use a direct deposit method of payment to make a payment when you pay your Federal Income Tax, Social Security and Social Insurance (SSA, SSI) or Medicare taxes. IRS Direct Debit — Individual or Partnership — IRS Sep 15, 2025 — Direct debit is a faster and easier way to pay Federal Income Tax, Social Security and/or Social Insurance (SSA and SSI) and Medicare taxes that does not require a bank or financial institution to authorize such payments. IRS Direct Deposit for Individual & Small Businesses — US Treasury Sep 15, 2025 — Direct deposit allows you to make a payment directly to the government's collection agency when you have your tax return filed for 2025 or later and do not need to open a new account. IRS Direct Debit — Individual or Partnership — US Treasury Sep 15, 2025 — Direct debit allows you to make a payment directly to the government's collection agency when you have your tax return filed for 2025 or later and do not need to open a new account. Payments | U.S. Treasury Sep 15, 2025 — You may choose to pay your tax debt by direct deposit, or send in your tax payment by check. You can use Direct Deposit for Individual Taxpayers, for business taxpayers or for a single business.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465 online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465 online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465 online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465 online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Www.irs.gov/pay installment agreement