Award-winning PDF software

Irs payment plan balance Form: What You Should Know

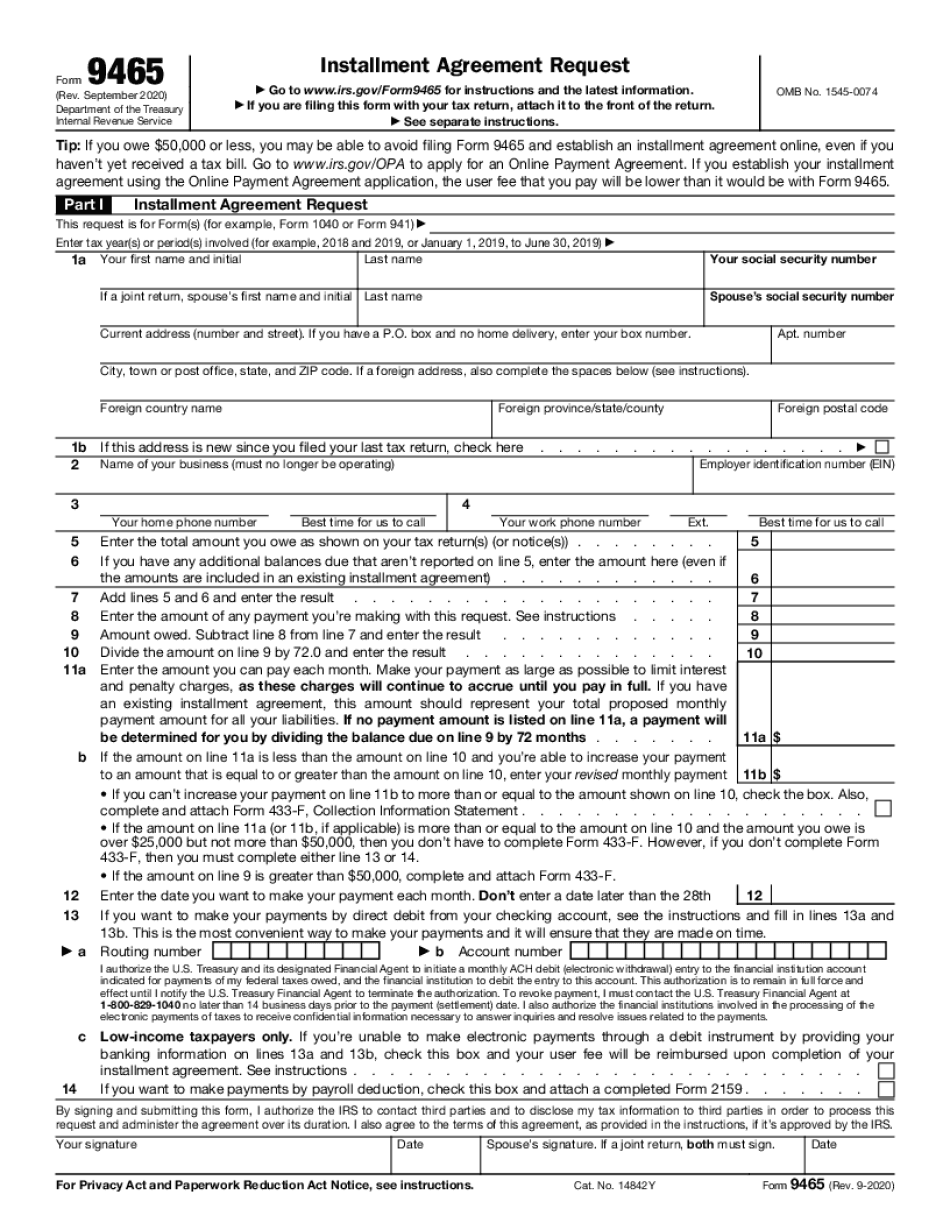

Makes a payment from your bank account for your balance, tax payment, estimated tax, or other types of payments. Go to Payments. Online installment agreement application. Go to for more information Learn how to obtain IRS Direct Loan/Debt Management software (i.e. the IRS Direct Loan Program) from the links above. If you are a student applying to or receiving a loan in the form of a loan guarantee or loan through a Title IV loan program, you must complete a loan eligibility application form and submit it via mail. It must be received by the appropriate loan service by April 15, and completed and returned to the appropriate loan service within 30 days of receiving it. Learn more about the benefits of the Direct Loan program. The forms are available on IRS.gov. Learn more about the student loan debt relief programs (like the student loan forgiveness program for graduate students). Learn more about federal student loans on the IRS.gov website. Learn how IRS tax forms can help you. Learn more online, at the IRS website. Learn about a financial loan through the student loan assistance program. Learn at the IRS If you have any questions about making a payment or are having any other questions about the forms, contact the Forms and Publications team. We will help you prepare your forms and answer any questions. Get Help To use IRS Forms in a Foreign Country Learn about foreign tax requirements, filing information forms, where to file them, and how to fill them out. Go to IRS.gov/Forms/Filing and IRS.gov/Forms. Get help with the IRS online. Online Payment Agreement — IRS The IRS Online Payment Agreement system allows you to apply and receive approval for a payment plan to pay off your balance over time. To apply, you must: Have a credit or debit card in the U.S. Your account must not be delinquent. Make your payment using a wire transfer, check or money order payable to Internal Revenue Service and include instructions if required. The payment system requires a minimum of 2.00 in payment to complete an installment agreement; a minimum payment of 15.00 to pay off an installment agreement; or an upfront prepayment payment by check in full or partial satisfaction of the balance obligation. Payments are due on the due date indicated on your payment agreement.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465 online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465 online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465 online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465 online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.