Hi and welcome students! Today's tutorial will cover Microsoft Excel 2016 and how to calculate a loan payment using the PMT function. The PMT function calculates loan payments based on the constant interest rate and constant payments. I'm going to use buying a car as my example for today's scenario. Let's go ahead and get started. So, I have car loans right here and I have a business loan request. Let's say that you're going out and you're going to buy a car for thirty thousand dollars, but you don't have any money. So, you need to take out a loan. Well, the loan amount is going to be thirty thousand dollars. So, I basically set up a spreadsheet here. It's very easy to set it up the same way if you want, no matter if it's a car loan, a house loan, or anything else that you might be looking at. So, right here, I put basically three columns. I have column A which is my first loan option, column B and column C, those are my three loan options right there. Let's say that I have three different options for this loan. As I said, the loan amount is right here, that's thirty thousand dollars for each of them. And then, I see that from there my numbers change a little bit. Right here is the annual interest rate, and then right here are the number of years. For instance, the first loan option says thirty thousand dollars for a six percent interest rate and five years. The next one says thirty thousand dollars, five percent interest rate, so a little bit lower of an annual interest rate, and then the number of years you have longer to pay it off. And finally, thirty thousand dollars, four percent interest rate,...

Award-winning PDF software

Irs payment plan calculator Form: What You Should Know

Get Ready to Get Paid! Learn about IRS e-file and the ability to use your credit and debit cards to make payments, track your funds and transfer funds between accounts. Go for a Pay As You Earn (PAY) for tax year 2018. Use a debit or credit card to make tax payments on a weekly recurring basis. Learn how your payments help to reduce your tax payment.

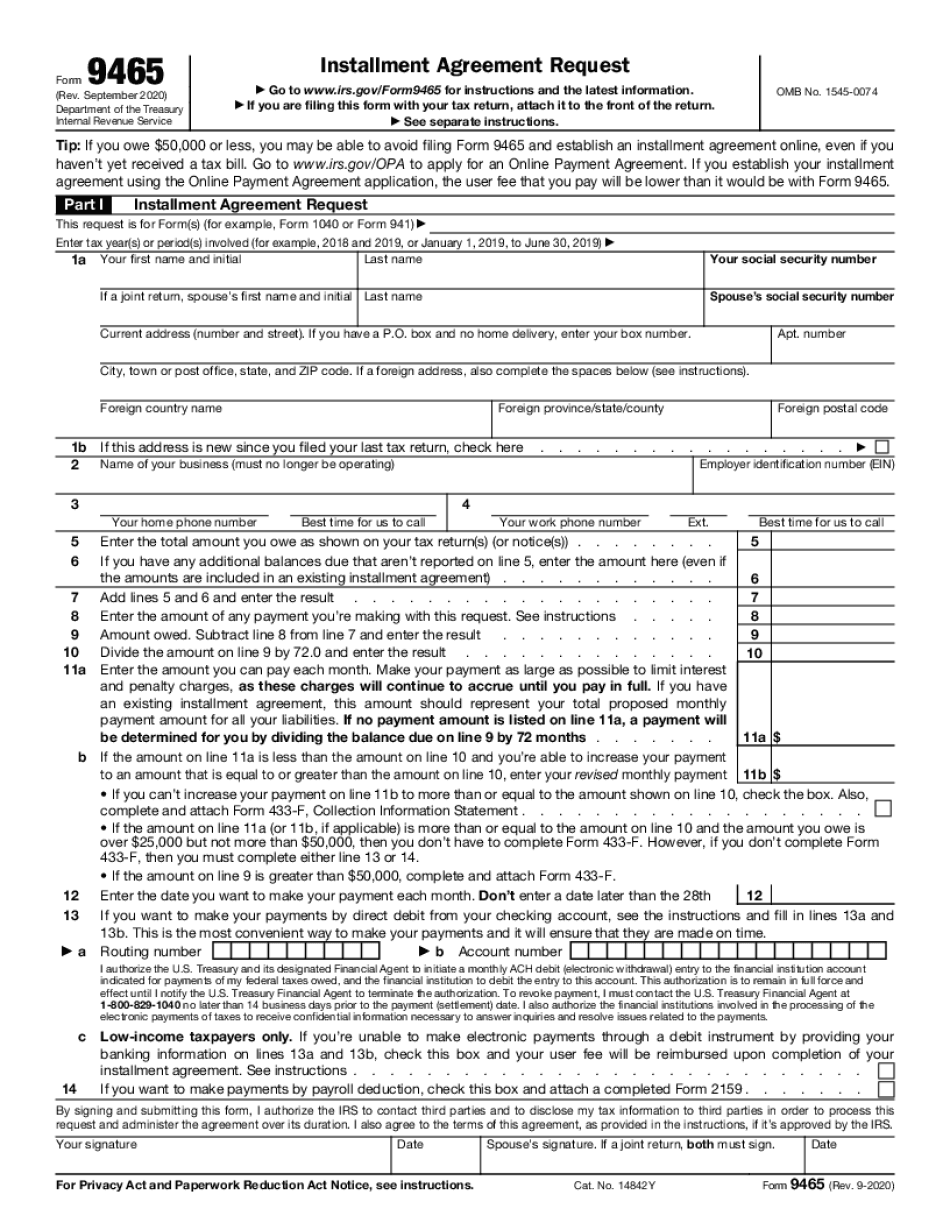

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465 online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465 online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465 online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465 online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs payment plan calculator