Alright, welcome back to Velshi rule! The 2019 tax season is set to begin in just ten days. However, there are concerns about whether the IRS will be able to process all of America's tax returns as usual due to the ongoing shutdown. The Treasury Department has recalled approximately 46,000 federal workers at the IRS, which accounts for a little more than half of the total 80,000 employees there. This puts additional strain on an already understaffed agency. Last year, we discussed how the IRS faced shortages of essential supplies such as staplers, pens, and paper. Now, with the IRS functioning at just half its usual capacity, and with a majority of employees working without pay, American taxpayers may have to wait longer for their refunds. With over 800,000 people affected by the government shutdown, many individuals may want to file their taxes earlier than usual in order to receive their returns promptly. Joining us today is Tony Reardon, National President of the National Treasury Employees Union, whose organization is currently suing the federal government for requiring employees to work without pay during the shutdown. Thank you for being here, Tony. During the previous tax season, the IRS had received approximately 18 million returns and processed just over six million refunds by February 2nd. This year, with an understaffed agency and a higher workload, the mission becomes even more challenging. What are your thoughts on the impact of this situation? It's important to note that in addition to the IRS staff, there are 800,000 federal employees who are suffering due to the shutdown. It's truly disheartening that in the United States, we have a government that cannot pay its employees on time. Turning our attention back to IRS employees, there is legitimate concern among taxpayers that they may not receive...

Award-winning PDF software

Government shutdown Irs Payment Plan Form: What You Should Know

Application To Receive A Reduction In User Fee For Installment Agreements Use this form to request a reduction in the payment date for installment agreements that would otherwise be charged to your account. If your application to reduce a payment date for an installment agreement is approved, the payment will be adjusted to the scheduled payment date in accordance with the agreed-upon payment schedule. Payment Schedule for Installment Agreements — IRS For an up-to-date list of IRS payment schedule information, or to request special schedules for special circumstances, use the Payment Schedule For Installment Agreements Installment Agreement Fees Use Form 4868 to determine the amount that you would owe under an Installment Agreement. How To File An IRS Form 4868. Application To Determine How Much You Should Pay Under An Installment Agreement Oct 23, 2025 — Use Form 4868 to determine the amount that you would owe under an Installment Agreement. Form 4868 — Payments Due Under Installment Agreements This form is used by you and an employer or other third-party payee to determine the amount that you need to pay if you are required by IRS rule to pay an installment under your employment agreement. Form 4868: Application for IRS To Determine How Much You Should Pay Under an Installment Agreement Use this form to request an amount from the IRS to determine if you should be able to pay the full amount on your application and form. How To Pay Your Income Tax Bill After Making A Payment Under an Installment Agreement For instructions on paying your income taxes in advance and to learn if a payment agreement is required and how much you may owe under an Installment Agreement or when you do not make such a payment, go to Paying Your Income Taxes Under an Installment Agreement. Note: If you have a payment agreement, be sure to keep your payment agreement for your records to assist you in determining future income or other taxable events. How to File an IRS Form 4868. Application To Determine How Much You Should Pay Under An Installment Agreement. If you receive an installment agreement, you may need to check your agreement, especially if the amount you owe under the agreement changes over time. Follow the instructions provided by the agency for doing this.

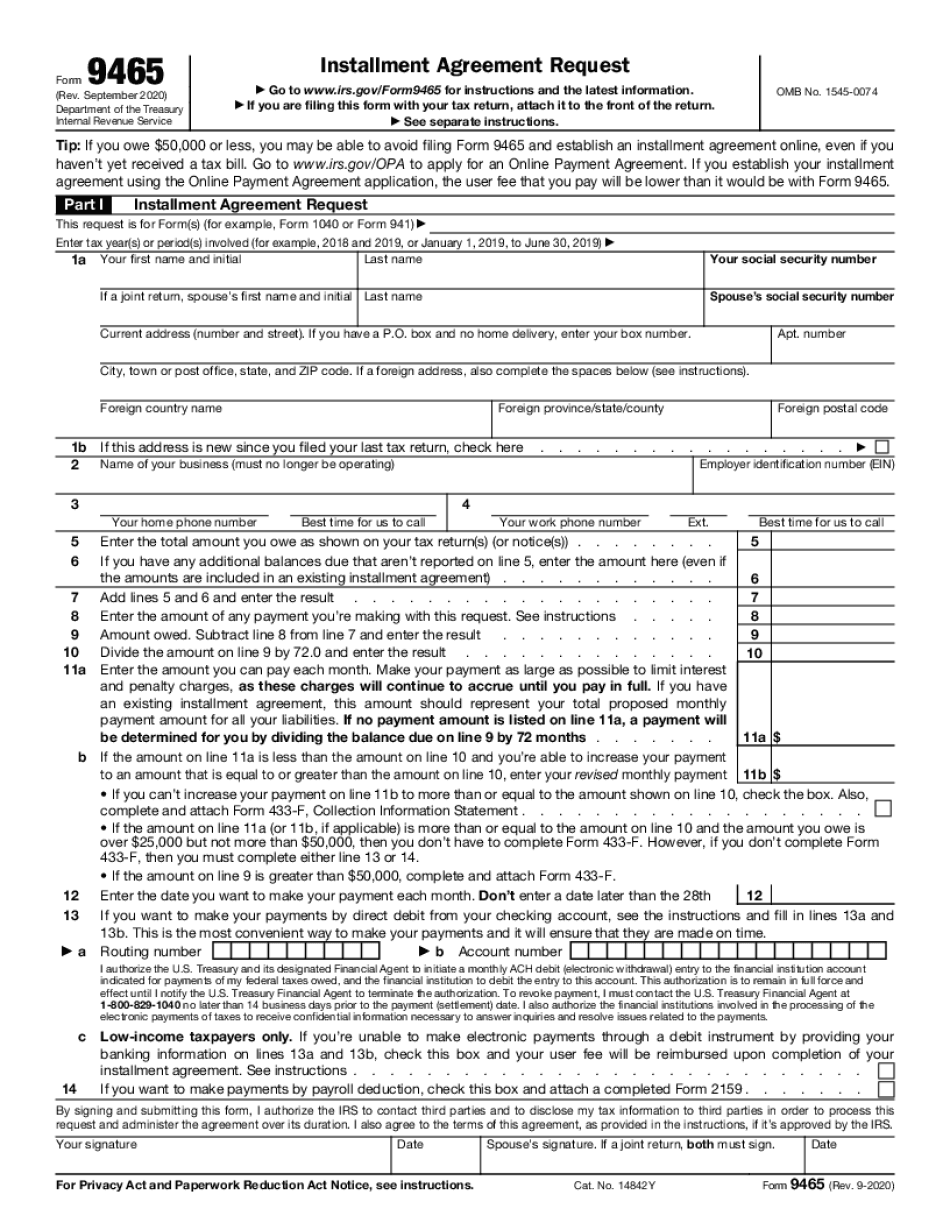

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465 online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465 online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465 online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465 online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Government shutdown irs payment plan