Award-winning PDF software

Manchester New Hampshire Form 9465 Online: What You Should Know

The department says it is offering free digital registration to all customers who submit an application online. (FULL STORY) May 10, 2025 — CONCORD, N.H. (AP) — As part of an effort to increase access to state recreation areas, the state of New Hampshire is allowing customers to pay with personal checks and electronic payments of credit card transactions. (FULL STORY) Tax Forms, Publications, and Online Shopping Cart Sep 7, 2025 — New Hampshire Office of Motor Vehicles Tax Forms to Include for Sale of Motor Vehicles and Motorcycles—New Hampshire Department of Highway Safety and Motor Vehicles is authorized to administer a state sales tax (8%) to be added to the purchase price of every new motor vehicle sold to residents and nonresidents. A sales-tax fee must be paid with each purchase of new motor vehicle. The fee is charged at the time of sale. New Hampshire sales tax rates are as follows: .086 percent for vehicles with a manufacturer's gross vehicle weight rating (GIVER) of 11,000 pounds or fewer. .105 percent for motor vehicles with a manufacturer GIVER of 12,001 pounds or fewer. .077 percent for motor vehicles with a manufacturer GIVER between 12,001 – 15,000 pounds (excluding boats). .069 percent for motor vehicles with a manufacturer GIVER between 15,001 – 25,000 pounds. .024 percent for motor vehicles with a manufacturer GIVER of 25,001 pounds or greater. The sales tax rate does not apply to commercial motor vehicles that have a manufacturer's gross vehicle weight rating (GMR) greater than 15,000 pounds and to trailers designed to carry more than 10,000 pounds. Commercial motor vehicles with a GIVER of 15,001 pounds or greater and trailers that are manufactured and built by or exclusively used by dealers are exempt from the sales tax if the vehicle is displayed only for sale on the dealership lot, in a display stand, or at a special event. New Hampshire sales tax rates do not apply to the repair, restoration, or construction of motor vehicles. Repair, restoration, and construction of motor vehicles by a business engaged in the business for profit (also sometimes called “repair shop” or “conversion”) is not taxable at the tax rate.

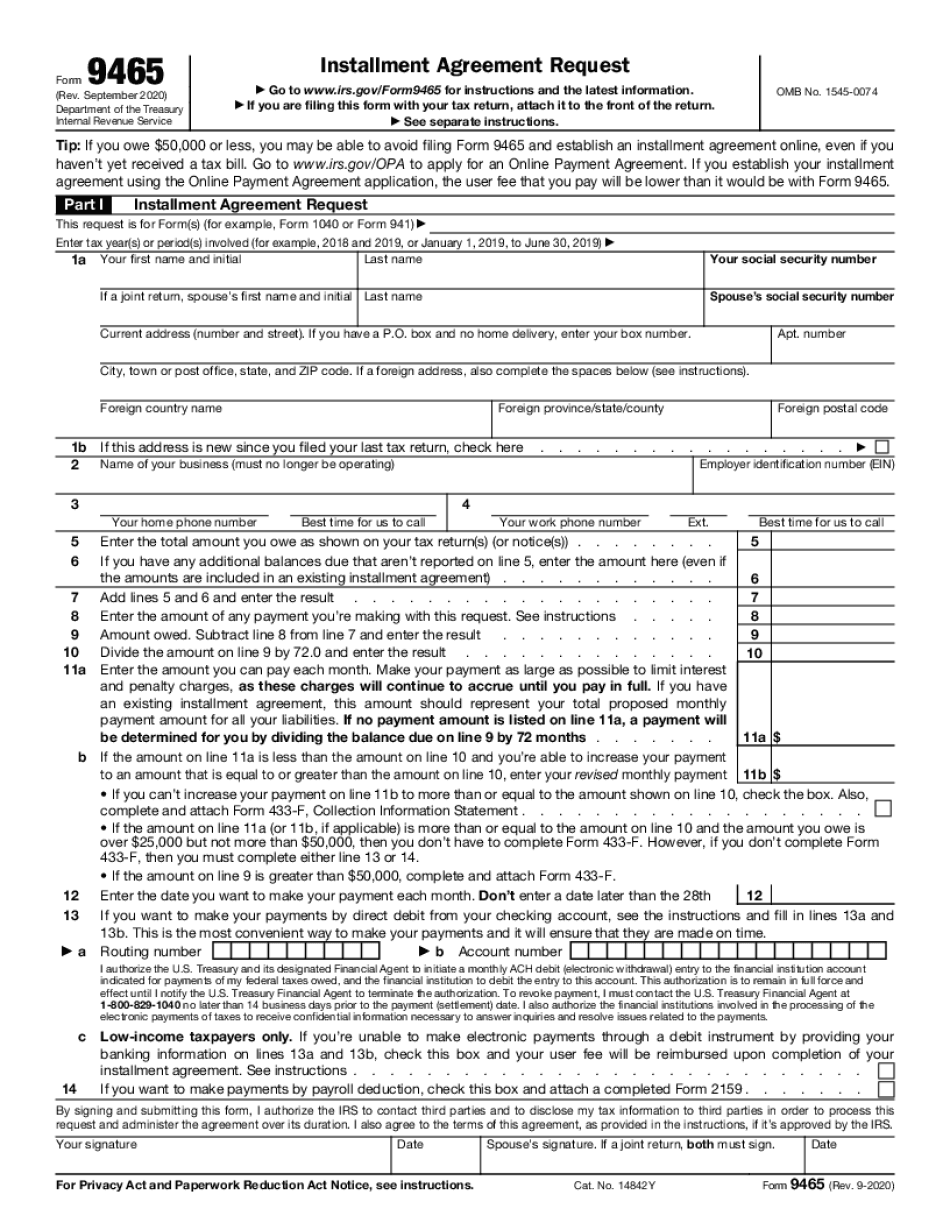

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Manchester New Hampshire Form 9465 Online, keep away from glitches and furnish it inside a timely method:

How to complete a Manchester New Hampshire Form 9465 Online?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Manchester New Hampshire Form 9465 Online aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Manchester New Hampshire Form 9465 Online from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.