Award-winning PDF software

Form 9465 Online for Maryland: What You Should Know

For questions regarding this payment method, contact How To Make Online Bill Pay The Maryland online bill pay system is only available on mobile devices and web browsers. If you are utilizing a mobile phone, please be aware that you must have a Wi-Fi connection to use the online bill pay system. The Maryland state tax system requires an appropriate wireless internet connection that allows you access to the internet for billing and customer service purposes. A wireless internet access point is not considered an internet connection for payment purposes. Online bill pay is supported on the Microsoft Internet Explorer, Google Chrome, Mozilla Firefox, and Apple Safari browsers. A secure encrypted connection is used when accessing Maryland services. Your personal information is used to verify your identity when submitting account or account recovery requests. The Maryland State Controller's office receives a limited number of security incidents each month. If your Maryland payment account is compromised, the entire online payment system will not function. All the information available in the Maryland online payment system will be erased if a security incident is received. Tax Forms For Maryland What forms to file? There are 2 tax forms required for nonresident aliens and U.S. residents who are residents of Maryland. The required Forms 2105 and 2106 are located in the following location: Forms, Publication 4, “Taxation of Foreign Residents.” Is filing the Maryland income tax a pain? No. If you can answer yes to any of the following questions, submit these forms electronically rather than filing them off-line. Who should I file my returns with? What are my options if I can't file? Filed as Nonresident Alien? If you are a resident of another state, the forms may have a separate form to file in Maryland. Please consult that state's tax agency for their instructions. Filed as a U.S. Resident? If you are a U.S. citizen, you are automatically a resident of Maryland, for tax purposes. However, you would still file your tax returns and pay your tax obligations as a nonresident alien. If you have any questions about the residency or nonresidency status of your property or income, you should contact an attorney. Filed as an International Student? If you are an international student, and you will be filing as either a resident, nonresident, noncitizen, or a student, you are not required to file Maryland income tax returns.

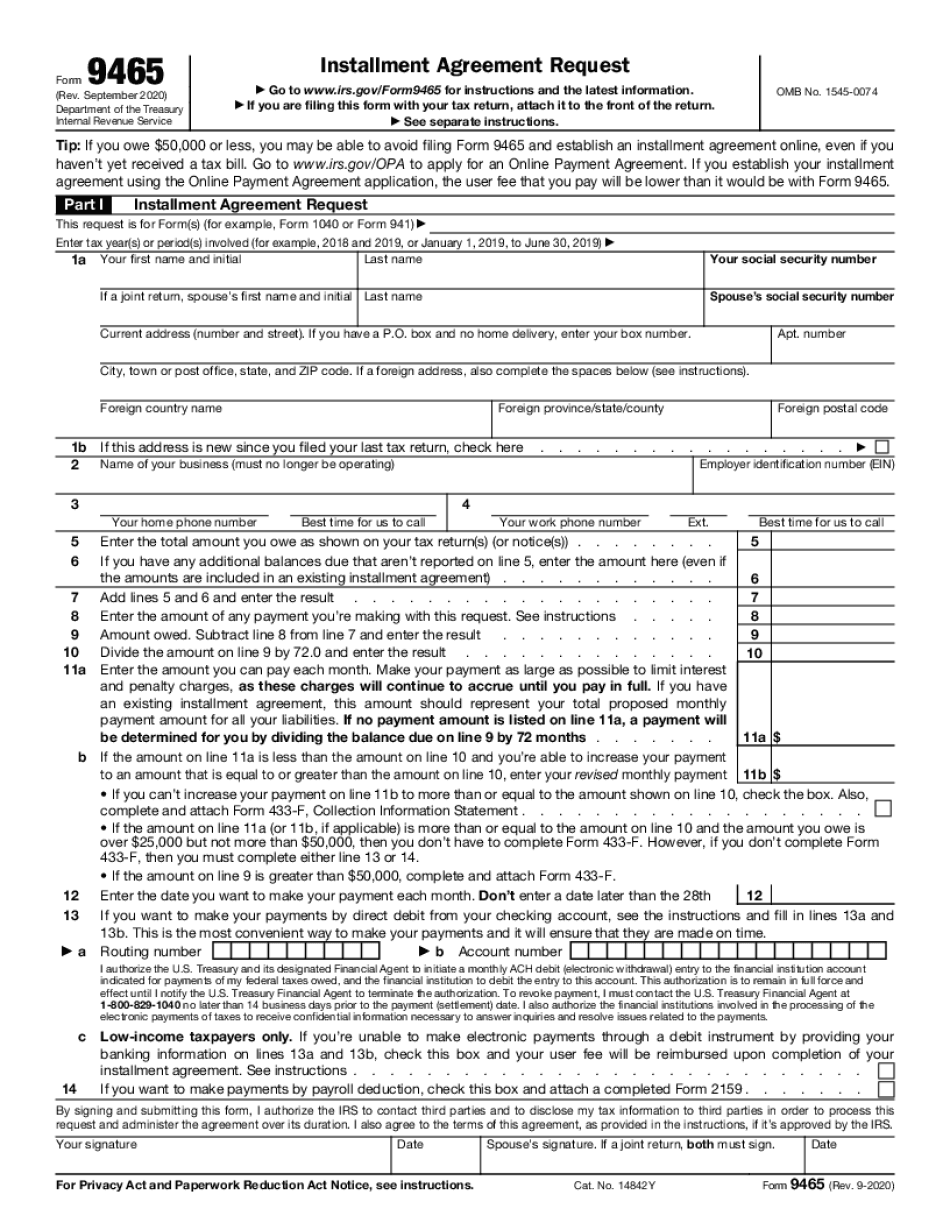

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9465 Online for Maryland, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9465 Online for Maryland?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9465 Online for Maryland aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9465 Online for Maryland from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.